A bill receivable template is a document which a customer agrees to pay at some future date. This bill is issued for the payment of goods, he/she has purchased as per transaction. A proper format is followed to draft a bill receivable, considering its importance in business world. The bill receivable format is used to secure the short term funding. It is sent by the debtor to the recipient to whom the amount is to be paid. The most commonly accepted bill receivable is a promissory note as well as bill of exchange. Moreover, it is a financial document generate by company when there are some due payments from the side of customer. Generally, it is used to record the full details of bills received from customers and others. All the details of the bill-date, receiver’s name, amount, term, place of payment are entered in the bill receivable book for presentation and further reference.

Details of Bill Receivable

Being a professional document, a bill receivable refers to the commitment made by a customer to pay the agreed liability at the deadline. It is a confirmation bill that, effectively replaces, one party’s commitment to release liability against mutually decided debt for the bill holder. A legally binding bill receivable can also be used to obtain financial assistance from any financial institution by surrender it. Nevertheless, this legal document can be prepared by a business or individual for securing the short term funding. In business dealings, sometimes a customer is willing to receive the pending amount from a company immediately, but due to fund management issues, companies opt for paying bill instead of cash. It can immediately release the liability without disturbing cash inflows and outflows. In most of the cases, a business manager or owner can call as receiver who’ll get some amounts from the debtor against all the services, products, or Goods customer has provided under the statement of bill receivable.

Advantages of Bill Receivable

Running a small business in a competitive world is a hard task. Being owner, you will make sure all your customers get your products or services without facing any hassles. This is because, nobody wish to welcome negative comments or feedback for customer, especially when not getting products or services due to non-availability of credit payments. To win the market share as well as hearts of customers, a business is required to offer various kind of credit plans. A bill receivable can be a helpful medium while facilitating customers who are in search of competitive credit plans as it offers amazing benefits. The most appealing benefits are given as follows;

1- Customer Satisfaction: Allowing credit sales for your customers can not only build trust, but also make them satisfied. This satisfaction level can enhance their loyalty and ultimately brings more sales to business.

2- Easy Accountable System: While increasing sales volume, a business can also use bill receivable system to track customer’s credit history and payment behavior. As sales volume grow, you will get more information about your new clients and by offering them bill receivables, you can turn them into long term customers. Perhaps, this system can also track various factors like; which products are getting popularity and which ones are bought on credit time and again.

3- More Bills means More Sales: As the numbers of bill receivable increases, it means your sales volume is growing and bringing more and more business. A credit buying increases sales volume as people don’t need to pay immediately. However, if these customers failed to pay by the deadline, your business may suffer heavy losses.

4- Information and Record: As sales numbers increase, more and more customers start interacting with your business. Therefore, with the help of a credit system, a business can obtain valuable information regarding who are buying products, at what terms sale is made and what is credit plan. A business can use this information for further strategic based decisions like; launching new products, going into a new market and capture more market share.

5- Working Capital Management: A bill receivable is part of working capital management, and it gives a business full control over cash management. In this way, a business can not only increase sales volume, but also can hold working capital funds for other payments. This can also alter temporary needs of short term borrowing and ultimately increases profit by saving markup amount.

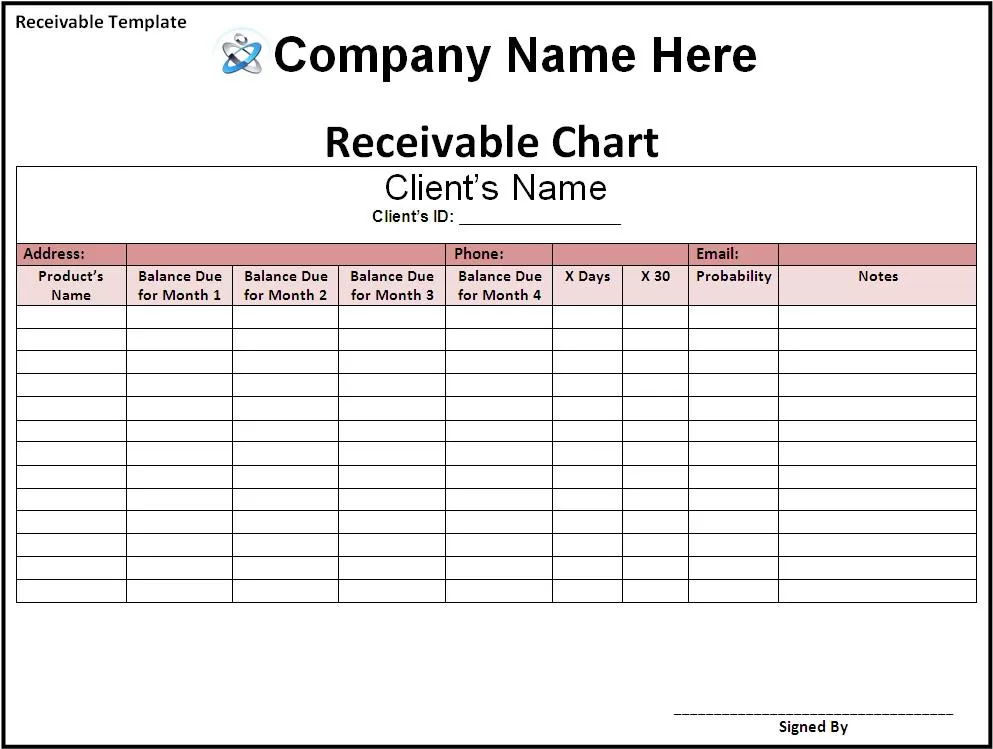

Quality of Bill Receivable Template

We tried our level best to provide you ready to use and turnkey bill receivable template which you can utilize spontaneously once downloaded. The above provided bill receivable template is a special example of high quality as far as professional forms are concerned. We believe in quality and therefore, offering our free template for downloading which will certainly met your quality standards. However, you may contact us for changes or amendment you may feel necessary in any template provided in this website.

Formats for Bill Receivable

exceldatapro.com

exceldatapro.com

msofficegeek.com

msofficegeek.com

templates.office.com

templates.office.com

www.templateroller.com

www.templateroller.com

www.business-in-a-box.com

www.business-in-a-box.com

spreadsheetpage.com

spreadsheetpage.com

invoicetemplates.com

invoicetemplates.com

template.wps.com

template.wps.com

template.wps.com

template.wps.com

www.excelcapmanagement.com

www.excelcapmanagement.com